How to Create an Account Tree

Overview

In Etendo, an Account Tree defines the structure of the Chart of Accounts (CoA) used by an organization. When creating a CoA from scratch, each element must be created individually and then organized into a hierarchical structure that reflects the organization’s financial statements.

The process starts by defining the main nodes for the Balance Sheet and Income Statement, and then progressively creating sub-nodes (Assets, Liabilities, Equity, Revenues, Expenses, etc.) until the full structure is built.

Account Tree creation

A chart of accounts creation from scratch implies to create each chart of accounts element one by one:

- Once created, the elements can be arranged in a hierarchical way according to the corresponding financial statement structure by using the Drag & Drop function of the Tree Structure feature.

- Moreover, Etendo considers the elements created in an alphanumerical order as a sorted list and finds the position in that sorted list where the new element needs to be positioned.

The steps to follow for the creation of a chart of accounts (CoA) are:

- select the Organization for which the CoA is going to be used while posting to ledger, for example F&B US Inc.

- enter the Name of the Chart of Accounts, for example Test CoA

- set it up as User Defined Type to distinguish it from the imported Chart of Accounts

- select the Tree as B&F International Group Element Value (Account, etc.).

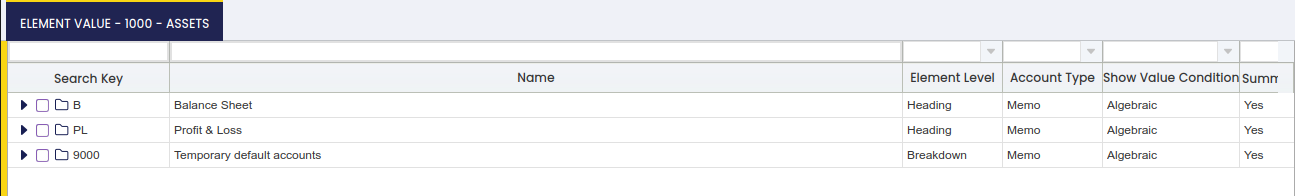

Move to Element Value tab.

The first thing to do in this tab is to create all the Heading elements one per each financial statement, for instance Balance Sheet and Income Statement.

Balance Sheet Node:

- create a new record

- enter B value in the field Search Key

- enter Balance Sheet value in the field Name

- select Heading in the Element Level field

- select Memo in the Account Type field

- select the value Algebraic in the field Show Value Condition

- set the field Summary Level to Yes

Profit and Loss Node:

- create a new record

- enter P&L value in the field Search Key

- enter Profit and Loss value in the field Name

- select Heading in the Element Level field

- select Memo in the Account Type field

- select the value Algebraic in the field Show Value Condition

- and set the field Summary Level to Yes

The next thing to do in this tab is to create one element value per each financial statement node:

- Balance Sheet nodes are Assets, Liabilities and Owner's Equity

- Profit and Loss nodes are Revenue and Cost of Goods Sold among others

Balance Sheet Elements

Let us focus first on explaining the creation of the nodes/elements of a Balance Sheet financial statement.

An organization's balance sheet shows its financial situation at a given point in time, the three sections of a balance sheet are:

- Assets

- Liabilities

- and Owner's equity

therefore the next step to take is to create one chart of account element per each balance sheet node:

Assets Node:

To create a new record, enter a value in the field Search Key, this value could be a number for instance (1000) or a name (Assets).

Info

It is recommended to use a number as that helps while creating a new chart of accounts elements. The following rule is considered while creating new chart of accounts elements:

Etendo first considers the elements in an alphanumerical order as a sorted list, finds the position in that sorted list where the new element needs to be positioned, looks at the element that precedes it and if that element is a summary element and the current element is not a summary one, adds the element as a children of that node otherwise add the element as a sibling of that node.

- enter Assets value in the field Name

- select Heading in the Element Level field

- select the value Asset in the field Account Type

- select the value Algebraic in the field Show Value Condition

- and set the field Summary Level to Yes

Once done, this node is dragged and dropped under the Balance Sheet node.

Liabilities Node:

- create a new record

- enter the value (2000) in the field Search Key

- enter Liabilities value in the field Name

- select Heading in the Element Level field

- select the value Liability in the field Account Type

- select the value Algebraic in the field Show Value Condition

- and set the field Summary Level to Yes

Owners Equity Node:

- create a new record

- enter the value (3000) in the field Search Key

- enter Owner's Equity value in the field Name

- select Heading in the Element Level field

- select the value Owner's Equity in the field Account Type

- select the value Algebraic in the field Show Value Condition

- and set the field Summary Level to Yes

Info

This time there is no need to drag and drop these two last nodes as Etendo does it according to the rule explained above.

Both the Liabilities Node and the Owner's Equity Node are summary nodes, therefore they are added as a sibling of the Asset Node (element that precedes them).

It is very common to break down assets and liabilities into current assets (or liabilities) and long-term assets (or liabilities).

Moreover, Assets can be split into Cash, Inventory and Accounts Receivable, Liabilities can be split into Accounts Payable and Note Payable and finally Owner's Equity can be split into Common Stock and Retained Earnings among others.

All of the above guides the creation of the following sub-nodes at a lower level underneath the heading nodes.

Current Assets Node:

- create a new record

- enter the value (1100) in the field Search Key

- enter Current Assets value in the field Name

- select Breakdown in the Element Level field

- select the value Assets in the field Account Type

- select the value Algebraic in the field Show Value Condition

- and set the field Summary Level to Yes

Once done, drag this node under the 1000-Assets node.

Long-Term Assets Node:

- create a new record

- enter the value (1500) in the field Search Key

- enter Long-term Assets value in the field Name

- select Breakdown in the Element Level field

- select the value Assets in the field Account Type

- select the value Algebraic in the field Show Value Condition

- and set the field Summary Level to Yes

Info

This time, there is no need to drag and drop this last node as Etendo does it according to the rule explained above.

The Long-term Asset Node is a summary node, therefore it is added as a sibling of the Current Asset Node (element that precedes it).

Current Liabilities Node:

- create a new record

- enter the value (2100) in the field Search Key

- enter Current Liabilities value in the field Name

- select Breakdown in the Element Level field

- select the value Liability in the field Account Type

- select the value Algebraic in the field Show Value Condition

- and set the field Summary Level to Yes

Once done, drag this node under the 2000-Liabilities node.

Long-Term Liabilities Node:

- create a new record

- enter the value (2500) in the field Search Key

- enter Long-term Liabilities value in the field Name

- select Breakdown in the Element Level field

- select the value Liability in the field Account Type

- select the value Algebraic in the field Show Value Condition

- and set the field Summary Level to Yes

Info

This time, there is no need to drag and drop this last node as Etendo does it according to the rule explained above.

The Long-term Liabilities Node is a summary node, therefore it is added as a sibling of the Current Liabilities Node (element that precedes it).

Cash Node:

- create a new record

- enter the value (1110) in the field Search Key

- enter Cash value in the field Name

- select Account in the Element Level field

- select the value Asset in the field Account Type

- select the value Algebraic in the field Show Value Condition

- and set the field Summary Level to Yes

Once done, drag this node under the 1100-Current Assets node.

Accounts Receivable Node:

- create a new record

- enter the value (1120) in the field Search Key

- enter Accounts Receivable value in the field Name

- select Account in the Element Level field

- select the value Asset in the field Account Type

- select the value Algebraic in the field Show Value Condition

- and set the field Summary Level to Yes

Info

This time, there is no need to drag and drop this last node as Etendo does it according to the rule explained above.

The Accounts Receivable Node is a summary node, therefore it is added as a sibling of the Cash Node Node (element that precedes it).

Cash Node needs to have subaccounts elements underneath, for instance:

111200 Checking Account

- create a new record

- enter 111200 in the field Search Key

- enter Checking Account value in the field Name

- select Subaccount in the Element Level field

- select the value Asset in the field Account Type

- and select the value Algebraic in the field Show Value Condition

111300 Checking In-Transfer

- create a new record

- enter 111300 in the field Search Key

- enter Checking In-Transfer value in the field Name

- select Subaccount in the Element Level field

- select the value Asset in the field Account Type

- and select the value Algebraic in the field Show Value Condition

111400 Petty Cash

- create a new record

- enter 111400 in the field Search Key

- enter Petty Cash value in the field Name

- select Subaccount in the Element Level field

- select the value Asset in the field Account Type

- and select the value Algebraic in the field Show Value Condition

Above subaccounts are the ones used while posting ledger entries into the ledger.

Info

There is no need to drag and drop the three subaccounts above into the corresponding node as Etendo does it.

Accounts Receivable Node needs to have subaccounts elements underneath, for instance:

112100 Trade Receivable

- create a new record

- enter 112100 in the field Search Key

- enter Trade Receivable value in the field Name

- select Subaccount in the Element Level field

- select the value Asset in the field Account Type

- and select the value Algebraic in the field Show Value Condition

112200 Tax Receivables

- create a new record

- enter 112200 in the field Search Key

- enter Tax Receivables value in the field Name

- select Subaccount in the Element Level field

- select the value Asset in the field Account Type

- and select the value Algebraic in the field Show Value Condition

Above subaccounts are the ones used while posting ledger entries into the ledger.

There is no need to drag and drop the two subaccounts above into the corresponding node as Etendo does it as explained above.

The same steps need to be followed for the creation of other Account and Subaccount node types under the nodes:

- Long-term Assets

- Current Liabilities

- Long-term Liabilities

- and Owner's Equity

Last but not least, it is required to create a node which summarizes assets, another one which summarizes liabilities and the last one which summarized owner's equity.

Let's take the creation of total assets node, for instance:

Total Assets Node

- create a new record

- enter 1900 in the field Search Key

- enter Total Assets value in the field Name

- enter 1100+1500 in the field Description as a way to describe that this node sums up current assets and long-term assets.

- select Heading in the Element Level field

- select the value Asset in the field Account Type

- and select the value Algebraic in the field Show Value Condition

- navigate to Customized Element tab

- create a new record

- enter 1 in the field Sign

- select the Account 1100 - Current Assets

- create a new record

- enter 1 in the field Sign

- select the Account 1500 - Long-term Assets

Income Statement Elements

Now, let us briefly explain the creation of the nodes/elements of an Income Statement.

An organization's income statement shows the company's financial performance over a period of time (usually one year), therefore it has two main sections:

- the first section details the organization revenues

- the second section details the organization expenses

The income statement also takes into account the cost of the goods sold, therefore the gross profit refers to the sum of an organization's revenues minus the cost of goods sold.

Besides, it is very common to separate the Operating Expenses from the Non-Operating Expenses, therefore it is possible to calculate the operating income as the difference between the gross profit and the operating expenses while the net income is the difference between the operating income and the non-operating expenses.

All of the above drives the creation of the nodes/ elements which once arranged will represent the structure of the organization's income statement.

The nodes to create for instance can be:

- The Revenue node:

- this Heading and Revenue account type node can include all the revenue subaccounts.

- The Total Revenue node:

- this Heading and Revenue account type node can include a customized element of the Revenue node above.

- The Cost of the Goods Sold node:

- this Heading and Expense account type node needs can include all the cost of the goods sold related subaccounts.

- The Total Cost of the Goods Sold node:

- this Heading and Expense account type node can include a customized element of the Cost of the Goods Sold node above.

- The Gross Margin node:

- this Heading and Revenue account type node is a customized element of the Revenue node and the Cost of the Goods Sold node above.

- the Operating Expenses node:

- this Heading and Expense account type node can include all the operating expense related subaccounts.

- The Total Operating Expense node:

- this Heading and Expense account type node can include a customized element of the Operating Expenses node above.

- The Operating Income node:

- this Heading and Revenue account type node can include a customized element of the Revenue node, the Cost of the Goods Sold node and the Operating Expenses node.

- The Non Operating Expense node:

- this Heading and Expense account type node can include all the non operating expense related subaccounts.

- The Total Non Operating Expenses node:

- this Heading and Expense account type node can include a customized element of the Non Operating Expense node above.

- and finally the Net Income node:

- this Heading and Revenue account type node can include a customized element of the Operating Income node above and the Total Non Operating Expense node above.

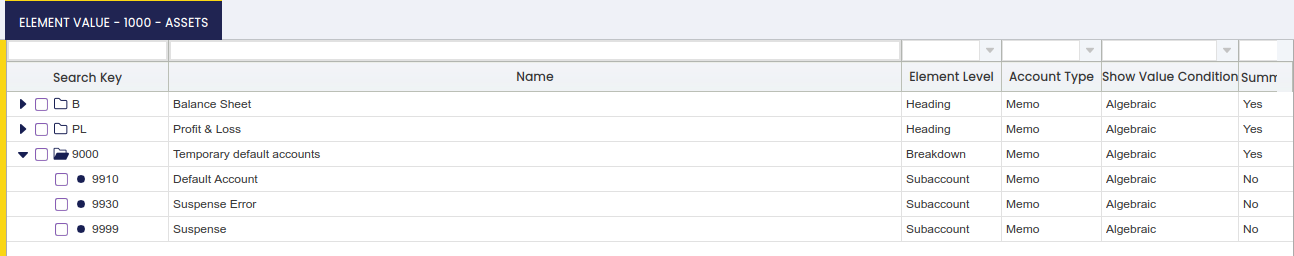

Temporary Elements

As already explained, there is a close relationship between an account tree and the General Ledger configuration in Etendo, as the Account Tree is a Dimension of the General Ledger.

The General Ledger configuration also includes a set of default accounts (or subaccounts in Etendo terms) to use while posting certain type of transactions. Those accounts need to be created in the account tree first and then be configured in the General Ledger Configuration tabs listed below:

Most of those defaults accounts are ledger accounts such as:

- the Income Summary account

- the Retained Earnings account

- the Vendor Liability account

- or the Customer Receivables account

However, there are a few of these accounts which are not ledger accounts but what we can call Temporary accounts such as the Suspense Balancing account.

Info

It is not necessary to create a default ledger account as those are created as part of the account tree.

However, temporary default accounts need to be created in the account tree under a specific tree branch or node, in order to get that the balance of those temporary accounts is not taken while launching either the Balance Sheet or the Income Statement.

Therefore, a new Heading and Summary element needs to be created in the Element Level tab, that element can be named Temporary Accounts.

Once created, the accounts below (subaccounts) can be created and move underneath it:

- Suspense Balancing account

- Suspense Error account

This work is a derivative of Financial Management by Openbravo Wiki, used under CC BY-SA 2.5 ES. This work is licensed under CC BY-SA 2.5 by Etendo.